Alexandria Real Estate Equities, Inc. Reports: 3Q24 and YTD 3Q24 Net Income per Share - Diluted of $0.96 and $2.18, respectively; and 3Q24 and YTD 3Q24 FFO per Share - Diluted, as Adjusted, of $2.37 and $7.08, respectively

|

Key highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD |

|

||

|

Operating results |

3Q24 |

|

3Q23 |

|

3Q24 |

|

3Q23 |

|

|

Total revenues: |

|

|

|

|

|

|

|

|

|

In millions |

$ 791.6 |

|

$ 713.8 |

|

$ 2,327.4 |

|

$ 2,128.5 |

|

|

Growth |

10.9 % |

|

|

9.3 % |

|

|

||

|

Net income attributable to Alexandria's common stockholders – diluted: |

||||||||

|

In millions |

$ 164.7 |

|

$ 21.9 |

|

$ 374.5 |

|

$ 184.4 |

|

|

Per share |

$ 0.96 |

|

$ 0.13 |

|

$ 2.18 |

|

$ 1.08 |

|

|

Funds from operations attributable to Alexandria's common stockholders – diluted, as adjusted: |

|

|

||||||

|

In millions |

$ 407.9 |

|

$ 386.4 |

|

$ 1,217.3 |

|

$ 1,142.5 |

|

|

Per share |

$ 2.37 |

|

$ 2.26 |

|

$ 7.08 |

|

$ 6.69 |

|

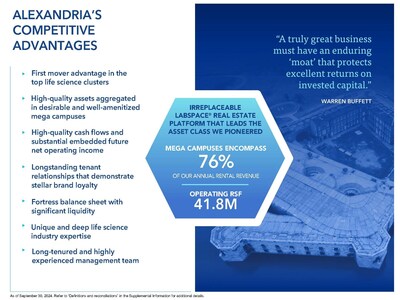

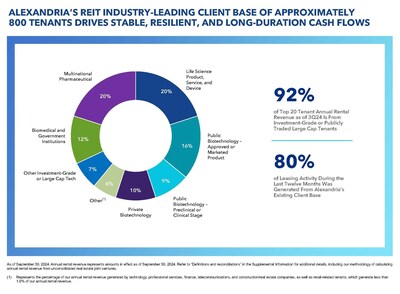

An industry-leading REIT with a high-quality, diverse tenant base and strong margins

|

(As of |

|

|

|

|

|

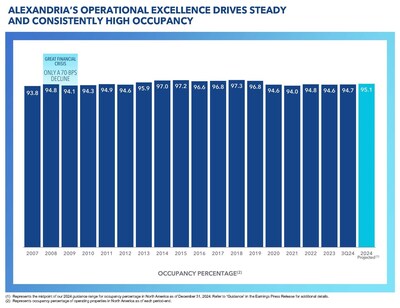

Occupancy of operating properties in |

|

94.7 % |

|

|

|

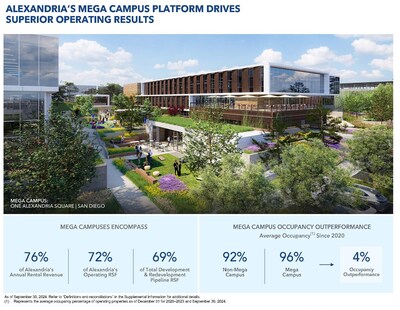

Percentage of annual rental revenue in effect from mega campuses |

|

76 % |

|

|

|

Percentage of annual rental revenue in effect from investment-grade or publicly |

|

53 % |

|

|

|

Operating margin |

|

71 % |

|

|

|

Adjusted EBITDA margin |

|

70 % |

|

|

|

Percentage of leases containing annual rent escalations |

|

96 % |

|

|

|

Weighted-average remaining lease term: |

|

|

|

|

|

Top 20 tenants |

|

9.5 |

years |

|

|

All tenants |

|

7.5 |

years |

|

|

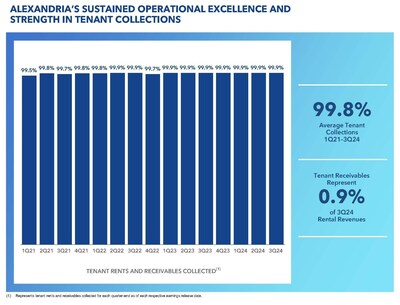

Sustained strength in tenant collections: |

|

|

|

|

|

Tenant receivables as a percentage of 3Q24 rental revenues |

|

0.9 % |

|

|

|

|

|

99.6 % |

|

|

|

3Q24 tenant rents and receivables collected as of |

|

99.9 % |

|

|

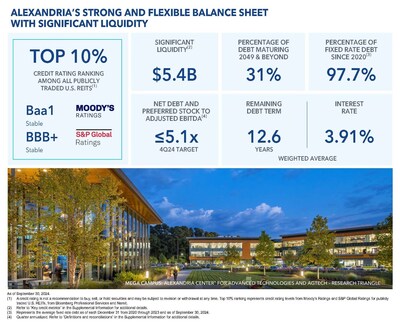

Strong and flexible balance sheet with significant liquidity; top 10% credit rating ranking among all publicly traded

- Net debt and preferred stock to Adjusted EBITDA of 5.5x and fixed-charge coverage ratio of 4.4x for 3Q24 annualized (targets for 4Q24 annualized of ≤5.1x and ≥4.5x, respectively).

- Significant liquidity of

$5.4 billion . - 31% of our total debt matures in 2049 and beyond.

- 12.6 years weighted-average remaining term of debt.

- Since 2020, an average of 97.7% of our debt has been fixed rate.

- Total debt and preferred stock to gross assets of 29%.

-

$1.0 billion of capital contribution commitments from existing consolidated real estate joint venture partners to fund construction from 4Q24 through 2027.

Strong leasing volume and solid rental rate changes

- Strong leasing volume aggregating 1.5 million RSF during 3Q24, up 48% compared to our previous four-quarter average of 1.0 million RSF.

- Rental rate changes on lease renewals and re-leasing of space were 5.1% and 1.5% (cash basis) for 3Q24 and 16.4% and 8.9% (cash basis) for YTD 3Q24.

- 80% of our leasing activity during the last twelve months was generated from our existing tenant base.

|

|

|

|

|

|

3Q24 |

|

|

YTD 3Q24 |

|

|

|

|

|

Total leasing activity – RSF |

|

1,486,097 |

|

|

3,742,955 |

|

|

|

|

|

Leasing of development and redevelopment space – RSF |

|

39,121 |

|

|

480,342 |

|

|

|

|

|

Lease renewals and re-leasing of space: |

|

|

|

|

|

|

|

|

|

|

RSF (included in total leasing activity above) |

|

1,278,857 |

|

|

2,863,277 |

|

|

|

|

|

Rental rate changes |

|

5.1 % |

(1) |

|

16.4 % |

|

|

|

|

|

Rental rate changes (cash basis) |

|

1.5 % |

(1) |

|

8.9 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Includes a five-year lease extension to an investment-grade rated technology tenant aggregating 357,136 RSF of recently acquired tech R&D space in our |

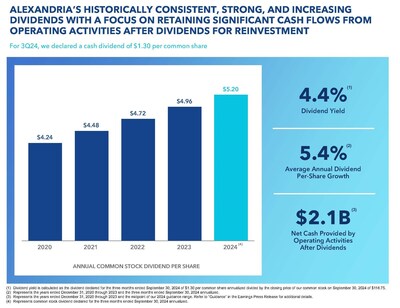

Attractive dividend strategy to share net cash flows from operating activities with stockholders while retaining a significant portion for reinvestment

- Common stock dividend declared for 3Q24 of

$1.30 per common share aggregating$5.14 per common share for the twelve months endedSeptember 30, 2024 , up24 cents , or 5%, over the twelve months endedSeptember 30, 2023 . - Dividend yield of 4.4% as of

September 30, 2024 . - Dividend payout ratio of 55% for the three months ended

September 30, 2024 . - Average annual dividend per-share growth of 5.4% from 2020 through 3Q24 annualized.

- Significant net cash flows from operating activities after dividends retained for reinvestment aggregating

$2.1 billion for the years endedDecember 31, 2020 through 2023 and including the midpoint of our 2024 guidance range for net cash provided by operating activities after dividends.

Ongoing successful execution of Alexandria's 2024 capital strategy

We expect to continue pursuing our strategy to fund a significant portion of our capital requirements for the year ending

|

(in millions) |

|

|

|

Completed dispositions of 100% interest in properties |

|

$ 319 |

|

Pending dispositions subject to non-refundable deposits |

|

577 |

|

Pending dispositions subject to executed letters of intent and/or purchase and sale agreements |

|

603 |

|

Forward equity sales agreements |

|

28 |

|

Total |

|

$ 1,527 |

|

2024 guidance midpoint for dispositions and common equity |

|

$ 1,550 |

Ongoing successful execution of Alexandria's 2024 capital strategy (continued)

- In

September 2024 , we completed the following transactions with our longstanding tenant,Fred Hutchinson Cancer Center ("Fred Hutch"), in theLake Union submarket:- Sale of

1165 Eastlake Avenue East , a fully leased 100,086 RSF single-tenant Class A+ life science facility that was developed in 2021. We sold the property for$150.0 million , or$1,499 per RSF, at strong capitalization rates of 4.7% and 4.9% (cash basis). Upon completion of the sale, we recognized a gain on sale of real estate aggregating$21.5 million . - Fred Hutch executed early renewals aggregating 117,479 RSF at our 1201 and 1208 Eastlake Avenue East properties, including a 15-year lease extension at

1201 Eastlake Avenue East . - Our prior joint venture partner sold their partial interest ownership in each of 1201 and 1208 Eastlake Avenue East to Fred Hutch. Our ownership interest in both properties remains unchanged at 30.0%. This sale, lease extensions, and new joint venture affirm Fred Hutch's commitment to

South Lake Union .

- Sale of

Alexandria's development and redevelopment pipeline delivered incremental annual net operating income of $21 million commencing during 3Q24 and is expected to deliver incremental annual net operating income aggregating $510 million primarily by 1Q28

- During 3Q24, we placed into service development and redevelopment projects aggregating 316,691 RSF that are 100% leased across multiple submarkets and delivered incremental annual net operating income of

$21 million . 3Q24 deliveries included 250,000 RSF at9820 Darnestown Road on the Alexandria Center® for Life Science –Shady Grove mega campus in ourRockville submarket. - Annual net operating income (cash basis) is expected to increase by

$57 million upon the burn-off of initial free rent, with a weighted-average burn-off period of approximately six months, from recently delivered projects. - 69% of the RSF in our total development and redevelopment pipeline is within our mega campuses.

|

|

|

Development and Redevelopment Projects |

|

Incremental

Annual Net |

|

RSF |

|

Leased/ Percentage |

||

|

|

|

(dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

Placed into service: |

|

|

|

|

|

|

|

|

|

|

|

1H24 |

|

$ 42 |

|

628,427 |

|

|

100 % |

|

|

|

|

3Q24 |

|

21 |

|

316,691 |

|

|

100 |

|

|

|

|

Placed into service in YTD 3Q24 |

|

$ 63 |

|

945,118 |

|

|

100 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expected to be placed into service(1): |

|

|

|

|

|

|

|

|

|

|

|

4Q24 through 4Q25 |

|

$ 158 |

(2) |

5,467,897 |

|

|

55 % |

|

|

|

|

1Q26 through 1Q28 |

|

352 |

|

|

|

(3) |

||

|

|

|

|

|

$ 510 |

|

|

|

|

||

|

|

|

|

|

(1) |

Represents expected incremental annual net operating income to be placed into service from deliveries of |

|

|

|

|

|

(2) |

Includes (i) 1.0 million RSF that is expected to stabilize through 2025 and is 92% leased/negotiating and |

|

|

|

|

|

(3) |

70% of the leased RSF of our development and redevelopment projects was generated from our existing |

Continued solid net operating income and internal growth

- Net operating income (cash basis) of

$2.0 billion for 3Q24 annualized, up$274.2 million , or 15.5%, compared to 3Q23 annualized. - Same property net operating income growth of 1.5% and 6.5% (cash basis) for 3Q24 over 3Q23 and 1.6% and 4.6% (cash basis) for YTD 3Q24 over YTD 3Q23.

- 96% of our leases contain contractual annual rent escalations approximating 3%.

Strong balance sheet management

Key metrics as of or for the three months ended

-

$33.1 billion in total market capitalization. -

$20.5 billion in total equity capitalization, which ranks in the top 10% among all publicly tradedU.S. REITs.

|

|

|

3Q24 |

|

Target |

||

|

|

|

Quarter |

|

Trailing 12 Months |

|

4Q24 Annualized |

|

Net debt and preferred stock to |

|

5.5x |

|

5.6x |

|

Less than or equal to 5.1x |

|

Fixed-charge coverage ratio |

|

4.4x |

|

4.5x |

|

Greater than or equal to 4.5x |

Key capital events

- In

September 2024 , we amended and restated our unsecured senior line of credit to, among other changes, extend the maturity date fromJanuary 22, 2028 toJanuary 22, 2030 , including extension options that we control. - During 3Q24, we had no activity under our ATM program. As of

October 21, 2024 , the remaining aggregate amount available for future sales of common stock was$1.47 billion .

Investments

- As of

September 30, 2024 :- Our non-real estate investments aggregated

$1.5 billion . - Unrealized gains presented in our consolidated balance sheet were

$166.2 million , comprising gross unrealized gains and losses aggregating$284.4 million and$118.2 million , respectively.

- Our non-real estate investments aggregated

- Investment income of

$15.2 million for 3Q24 presented in our consolidated statement of operations consisted of$23.0 million of realized gains and$2.6 million of unrealized gains, partially offset by$10.3 million of impairment charges.

Other key highlights

|

Key items included in net income attributable to Alexandria's common stockholders: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

YTD |

|

||||||

|

|

3Q24 |

|

3Q23 |

|

3Q24 |

|

3Q23 |

|

3Q24 |

|

3Q23 |

|

3Q24 |

|

3Q23 |

|

|

(in millions, except per share |

Amount |

|

Per Share – |

|

Amount |

|

Per Share – |

|

||||||||

|

Unrealized gains (losses) on |

$ 2.6 |

|

|

|

$ 0.02 |

|

$ (0.45) |

|

|

|

$ (221.0) |

|

$ (0.19) |

|

$ (1.29) |

|

|

Gain on sales of real estate |

27.1 |

|

— |

|

0.16 |

|

— |

|

27.5 |

|

214.8 |

|

0.16 |

|

1.26 |

|

|

Impairment of non-real estate |

(10.3) |

|

(28.5) |

|

(0.06) |

|

(0.17) |

|

(37.8) |

|

(51.5) |

|

(0.22) |

|

(0.30) |

|

|

Impairment of real estate |

(5.7) |

|

(20.6) |

|

(0.03) |

|

(0.12) |

|

(36.5) |

|

(189.2) |

|

(0.22) |

|

(1.11) |

|

|

Acceleration of stock |

— |

|

(1.9) |

|

— |

|

(0.01) |

|

— |

|

(1.9) |

|

— |

|

(0.01) |

|

|

Total |

$ 13.7 |

|

$ (128.2) |

|

$ 0.09 |

|

$ (0.75) |

|

|

|

$ (248.8) |

|

$ (0.47) |

|

$ (1.45) |

|

|

Refer to "Funds from operations and funds from operations per share" in the Earnings Press Release for additional |

|

|||||||||||||||

Subsequent events

- In

October 2024 , we agreed to sell four properties located in ourGreater Boston market for a sales price of$369.4 million to the current tenant of the properties with whom we have a long-established relationship. The sales price represents capitalization rates of 8.5% and 6.3% (cash basis) based upon net operating income and net operating income (cash basis), respectively, for 3Q24 annualized. These properties, acquired primarily during 2020–2021, are currently 100% leased with a weighted-average remaining lease term of 18 years. InOctober 2024 , we recognized an impairment charge aggregating$40.9 million to reduce the carrying amounts of these properties by approximately 10% to the expected sales price less costs to sell. Our decision to dispose of these properties is based on their non-strategic location and the significant capital that the expected sales proceeds provide for immediate reinvestment into our development and redevelopment pipeline. - In

October 2024 , we agreed to sell five operating properties aggregating 203,223 RSF and land parcels aggregating 1.5 million SF in our Sorrento Mesa andUniversity Town Center submarkets to buyers that are expected to develop residential properties on these sites for an aggregate sales price of approximately$314.0 million . InOctober 2024 , we recognized impairment charges aggregating$65.9 million to reduce the carrying amounts of these properties to the expected aggregate sales price less costs to sell. Our decision to dispose of these assets, which are not integral to our mega campus strategy, is primarily based on the substantial capital that the sales proceeds will provide for immediate reinvestment into our development and redevelopment pipeline.

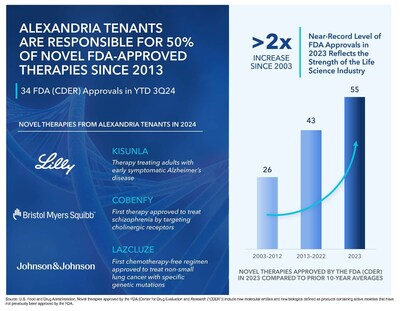

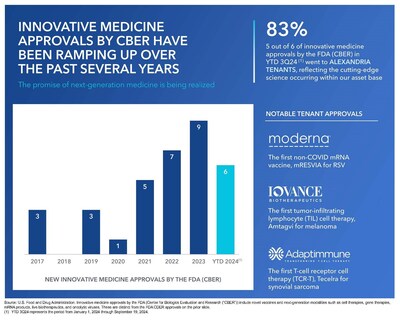

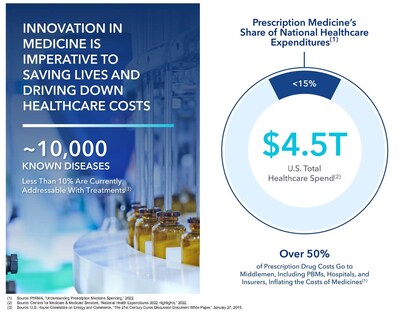

Industry and corporate responsibility leadership: catalyzing and leading the way for positive change to benefit human health and society

- In

September 2024 , Alexandria was named one of the World's Most Trustworthy Companies by Newsweek. This significant distinction builds on the Company's recognition by the publication as one of America's Most Trustworthy Companies in 2023 and 2024. Alexandria is one of only three S&P 500 REITs recognized in the real estate and housing category. - In

September 2024 , Alexandria and its executive chairman and founder,Joel S. Marcus , were honored with the inaugural Bisnow Life Sciences Icon & Influencer Award. This prestigious award highlightsMr. Marcus and the Company's significant long-term contributions to and lasting impact on the life science real estate sector and broader life science industry.Mr. Marcus accepted the award on his own behalf and that of Alexandria atBisnow's International Life Sciences & Biotech Conference , where he was also the keynote speaker. - Alexandria continued to receive broad recognition for our operational excellence in asset management, design, development, and sustainability, including the following recent awards:

- In our

Greater Boston market, the atrium at325 Binney Street , located on the Alexandria Center® atOne Kendall Square mega campus, is a light-filled collaboration space with a terraced garden and communal staircase that was celebrated for design excellence in the Science & Research – Small (under 50,000 SF) category of the 2024 International Interior Design AssociationNew England (IIDA NE) Design Awards and also received the award program's top honor, Best in Show. - In our

Maryland market, we were awarded three 2024 NAIOP DC|MD Awards of Excellence for developments and enhancements on the Alexandria Center® for Life Science –Shady Grove mega campus:9810 and 9820 Darnestown Road for Best Life Science Facility,9800 Medical Center Drive for Best Amenity Space, and9950 Medical Center Drive for Best Industrial/Flex. - We received a 2024 Nareit Sustainable Design Impact Award for our groundbreaking approach to utilizing alternative energy sources such as geothermal energy and wastewater heat recovery systems to reduce operational greenhouse gas emissions in Labspace® development projects in our

Greater Boston andSeattle markets. - Alexandria GradLabs® at

9880 Campus Point Drive , located on theCampus Point by Alexandria mega campus in ourSan Diego market, earned a 2024International Institute for Sustainable Laboratories (I2SL) Lab Buildings and Projects Award for Excellence in Energy Efficiency. The state-of-the-art building was designed to operate as a highly energy-efficient research facility. In 2023, the LEED Platinum certified facility earned an I2SL Labs2Zero pilot Energy Score of 96 out of 100, indicating its operational energy performance is better than 96% of similar facilities.

- In our

About

|

Guidance

|

|

|

|

The following guidance for 2024 has been updated to reflect our current view of existing market conditions and assumptions for the year ending |

|

|

|

|

|

|

|

2024 Guidance Midpoint |

||||

|

Summary of Key Changes in Guidance |

|

As of |

|

As of |

|

Summary of Key Changes in Sources and Uses of Capital |

|

As of |

|

As of |

|

EPS, FFO per share, and FFO per share, as adjusted |

|

See updates below |

|

Cash expected to be held at |

|

|

|

$— |

||

|

Straight-line rent revenue |

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Credit Metric Targets(1) |

|

|

|

Net debt and preferred stock to Adjusted EBITDA – 4Q24 annualized |

|

Less than or equal to 5.1x |

|

Fixed-charge coverage ratio – 4Q24 annualized |

|

Greater than or equal to 4.5x |

|

|

|

||||||||

|

Projected 2024 Earnings per Share and Funds From Operations per Share Attributable to |

|

||||||||

|

|

|

As of |

|

As of |

|

||||

|

Earnings per share(2) |

|

|

|

|

|

||||

|

Depreciation and amortization of real estate assets |

|

|

6.05 |

|

|

|

5.95 |

|

|

|

Gain on sales of real estate(3) |

|

|

(0.38) |

|

|

|

— |

|

|

|

Impairment of real estate – rental properties and land(4) |

|

|

0.67 |

|

|

|

0.01 |

|

|

|

Allocation to unvested restricted stock awards |

|

|

(0.06) |

|

|

|

(0.05) |

|

|

|

Funds from operations per share(1) |

|

|

|

|

|

||||

|

Unrealized losses on non-real estate investments |

|

|

0.19 |

|

|

|

0.20 |

|

|

|

Impairment of non-real estate investments |

|

|

0.22 |

|

|

|

0.16 |

|

|

|

Impairment of real estate |

|

|

0.17 |

|

|

|

0.17 |

|

|

|

Allocation to unvested restricted stock awards |

|

|

(0.01) |

|

|

|

(0.01) |

|

|

|

Funds from operations per share, as adjusted(1) |

|

|

|

|

|

||||

|

Midpoint |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

Certain |

|||||

|

Key Sources and Uses of Capital |

|

Range |

|

Midpoint |

|

||||

|

Sources of capital: |

|

|

|

|

|

|

|

|

|

|

Incremental debt |

|

$ 885 |

|

$ 1,185 |

|

$ 1,035 |

|

See below |

|

|

Net cash provided by operating activities after |

|

400 |

|

500 |

|

450 |

|

|

|

|

Dispositions and common equity(5) |

|

1,050 |

|

2,050 |

|

1,550 |

|

(5) |

|

|

Total sources of capital |

|

$ 2,335 |

|

$ 3,735 |

|

$ 3,035 |

|

|

|

|

Uses of capital: |

|

|

|

|

|

|

|

|

|

|

Construction |

|

$ 1,950 |

|

$ 2,550 |

|

$ 2,250 |

|

|

|

|

Acquisitions |

|

250 |

|

750 |

|

500 |

|

$ 249 |

|

|

Ground lease prepayment(6) |

|

135 |

|

135 |

|

135 |

|

|

|

|

Cash expected to be held at |

|

— |

|

300 |

|

150 |

|

|

|

|

Total uses of capital |

|

$ 2,335 |

|

$ 3,735 |

|

$ 3,035 |

|

|

|

|

Incremental debt (included above): |

|

|

|

|

|

|

|

|

|

|

Issuance of unsecured senior notes payable(8) |

|

$ 1,000 |

|

$ 1,000 |

|

$ 1,000 |

|

$ 1,000 |

(8) |

|

Unsecured senior line of credit, commercial paper, |

|

(115) |

|

185 |

|

35 |

|

|

|

|

Net incremental debt |

|

$ 885 |

|

$ 1,185 |

|

$ 1,035 |

|

|

|

|

|

|

|

|

|

|

|

Key Assumptions |

|

Low |

|

High |

|

|

Occupancy percentage in |

|

94.6 % |

|

95.6 % |

|

|

Lease renewals and re-leasing of space: |

|

|

|

|

|

|

Rental rate changes |

|

11.0 % |

|

19.0 % |

|

|

Rental rate changes (cash basis) |

|

5.0 % |

|

13.0 % |

|

|

Same property performance: |

|

|

|

|

|

|

Net operating income changes |

|

0.5 % |

|

2.5 % |

|

|

Net operating income changes (cash basis) |

|

3.0 % |

|

5.0 % |

|

|

Straight-line rent revenue(9) |

|

$ 147 |

|

$ 162 |

|

|

General and administrative expenses(10) |

|

$ 176 |

|

$ 186 |

|

|

Capitalization of interest |

|

$ 325 |

|

$ 355 |

|

|

Interest expense |

|

$ 154 |

|

$ 184 |

|

|

Realized gains on non-real estate investments(11) |

|

$ 95 |

|

$ 125 |

|

|

|

|

|

(1) |

Refer to "Definitions and reconciliations" in the Supplemental Information for additional details. |

|

(2) |

Excludes unrealized gains or losses on non-real estate investments after |

|

(3) |

Includes |

|

(4) |

Includes |

|

(5) |

We expect to fund our remaining capital requirements for the year ending |

|

(6) |

In |

|

(7) |

The increase in cash expected to be held at |

|

(8) |

Represents |

|

(9) |

Reduction in the midpoint of our guidance range for straight-line rent revenue by |

|

(10) |

Reduction in the midpoint of our guidance range for general and administrative expense by |

|

(11) |

Represents realized gains and losses included in funds from operations per share – diluted, as adjusted, and excludes significant impairments realized on non-real estate investments, if any. Refer to "Investments" in the Supplemental Information for additional details. |

|

Acquisitions |

|||||||||||||||||

|

Property |

|

Submarket/Market |

|

Date of Purchase |

|

Number of |

|

Operating Occupancy |

|

Square Footage |

|

Purchase Price |

|||||

|

|

|

|

|

Future |

|

Operating With |

|

||||||||||

|

|

|

|

|

|

|

||||||||||||

|

Completed in 1H24: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

285, 299, 307, and |

|

|

|

|

|

— |

|

N/A |

|

1,040,000 |

|

— |

|

$ |

155,321 |

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

201,811 |

|

|

Completed in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

100 % |

|

|

— |

|

88,514 |

|

|

47,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

249,411 |

|

|

2024 guidance range for acquisitions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

We expect to provide total estimated costs and related yields for development and significant redevelopment projects in the future, subsequent to the commencement of construction. |

|

|

|||||||||||||||||||

|

Dispositions |

|||||||||||||||||||

|

Property |

|

Submarket/Market |

|

Date of |

|

Interest |

|

RSF |

|

Capitalization |

|

Capitalization (Cash Basis) |

|

Sales Price |

|

Sales Price |

|||

|

Completed in 1H24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 17,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Completed in 3Q24: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale to longstanding tenant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 % |

|

|

100,086 |

|

4.7 % |

|

|

4.9 % |

|

|

149,985 |

(1) |

$ 1,499 |

|

Dispositions of properties not integral to our mega campus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 % |

|

|

349,947 |

|

N/A |

|

|

N/A |

|

|

60,000 |

(2) |

N/A |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,511 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

221,496 |

(3) |

|

|

Dispositions completed in YTD 3Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

238,709 |

|

|

|

Completed in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dispositions of properties not integral to our mega campus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 % |

|

|

248,186 |

|

7.6 % |

|

|

7.4 % |

|

|

80,500 |

(4) |

$ 324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

319,209 |

|

|

|

Pending 4Q24 dispositions subsequent to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subject to non-refundable deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale to longstanding tenant |

|

|

|

4Q24 |

|

100 % |

|

|

|

|

8.5 % |

|

|

6.3 % |

|

|

369,439 |

(5) |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

207,713 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

577,152 |

|

|

|

Subject to executed letters of intent and/or purchase and sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

602,500 |

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,179,652 |

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 1,498,861 |

|

|

|

2024 guidance range for dispositions and common equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

(1) |

Upon completion of the sale, we recognized a gain on sale of real estate aggregating |

|

(2) |

The property was leased to a single tenant with a |

|

(3) |

Dispositions completed during the three months ended |

|

(4) |

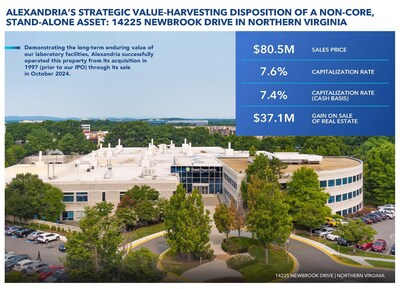

Demonstrating the long-term enduring value of our laboratory facilities, Alexandria successfully operated our only asset in the |

|

(5) |

Refer to "Subsequent events" in the Earnings Press Release for additional details. |

|

(6) |

Pending dispositions subsequent to |

Earnings Call Information and About the Company

We will host a conference call on

Additionally, a copy of this Earnings Press Release and Supplemental Information for the third quarter ended

For any questions, please contact corporateinformation@are.com;

About the Company

Forward-Looking Statements

This document includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our 2024 earnings per share, 2024 funds from operations per share, 2024 funds from operations per share, as adjusted, net operating income, and our projected sources and uses of capital. You can identify the forward-looking statements by their use of forward-looking words, such as "forecast," "guidance," "goals," "projects," "estimates," "anticipates," "believes," "expects," "intends," "may," "plans," "seeks," "should," "targets," or "will," or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, lower than expected yields, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, failure to obtain LEED and other healthy building certifications and efficiencies, and other risks and uncertainties detailed in our filings with the

This document is not an offer to sell or a solicitation to buy securities of

|

Consolidated Statements of Operations

|

||||||||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from rentals |

|

$ 775,744 |

|

$ 755,162 |

|

$ 755,551 |

|

$ 742,637 |

|

$ 707,531 |

|

$ 2,286,457 |

|

$ 2,099,819 |

|

Other income |

|

15,863 |

|

11,572 |

|

13,557 |

|

14,579 |

|

6,257 |

|

40,992 |

|

28,664 |

|

Total revenues |

|

791,607 |

|

766,734 |

|

769,108 |

|

757,216 |

|

713,788 |

|

2,327,449 |

|

2,128,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental operations |

|

233,265 |

|

217,254 |

|

218,314 |

|

222,726 |

|

217,687 |

|

668,833 |

|

636,454 |

|

General and administrative |

|

43,945 |

|

44,629 |

|

47,055 |

|

59,289 |

|

45,987 |

|

135,629 |

|

140,065 |

|

Interest |

|

43,550 |

|

45,789 |

|

40,840 |

|

31,967 |

|

11,411 |

|

130,179 |

|

42,237 |

|

Depreciation and amortization |

|

293,998 |

|

290,720 |

|

287,554 |

|

285,246 |

|

269,370 |

|

872,272 |

|

808,227 |

|

Impairment of real estate |

|

5,741 |

|

30,763 |

|

— |

|

271,890 |

|

20,649 |

|

36,504 |

|

189,224 |

|

Total expenses |

|

620,499 |

|

629,155 |

|

593,763 |

|

871,118 |

|

565,104 |

|

1,843,417 |

|

1,816,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated real estate joint ventures |

|

139 |

|

130 |

|

155 |

|

363 |

|

242 |

|

424 |

|

617 |

|

Investment income (loss) |

|

15,242 |

|

(43,660) |

|

43,284 |

|

8,654 |

|

(80,672) |

|

14,866 |

|

(204,051) |

|

Gain on sales of real estate |

|

27,114 |

|

— |

|

392 |

|

62,227 |

|

— |

|

27,506 |

|

214,810 |

|

Net income (loss) |

|

213,603 |

|

94,049 |

|

219,176 |

|

(42,658) |

|

68,254 |

|

526,828 |

|

323,652 |

|

Net income attributable to noncontrolling interests |

|

(45,656) |

|

(47,347) |

|

(48,631) |

|

(45,771) |

|

(43,985) |

|

(141,634) |

|

(131,584) |

|

Net income (loss) attributable to |

|

167,947 |

|

46,702 |

|

170,545 |

|

(88,429) |

|

24,269 |

|

385,194 |

|

192,068 |

|

Net income attributable to unvested restricted stock awards |

|

(3,273) |

|

(3,785) |

|

(3,659) |

|

(3,498) |

|

(2,414) |

|

(10,717) |

|

(7,697) |

|

Net income (loss) attributable to |

|

$ 164,674 |

|

$ 42,917 |

|

$ 166,886 |

|

$ (91,927) |

|

$ 21,855 |

|

$ 374,477 |

|

$ 184,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ 0.96 |

|

$ 0.25 |

|

$ 0.97 |

|

$ (0.54) |

|

$ 0.13 |

|

$ 2.18 |

|

$ 1.08 |

|

Diluted |

|

$ 0.96 |

|

$ 0.25 |

|

$ 0.97 |

|

$ (0.54) |

|

$ 0.13 |

|

$ 2.18 |

|

$ 1.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

172,058 |

|

172,013 |

|

171,949 |

|

171,096 |

|

170,890 |

|

172,007 |

|

170,846 |

|

Diluted |

|

172,058 |

|

172,013 |

|

171,949 |

|

171,096 |

|

170,890 |

|

172,007 |

|

170,846 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share of common stock |

|

$ 1.30 |

|

$ 1.30 |

|

$ 1.27 |

|

$ 1.27 |

|

$ 1.24 |

|

$ 3.87 |

|

$ 3.69 |

|

Consolidated Balance Sheets

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Investments in real estate |

|

$ 32,951,777 |

|

$ 32,673,839 |

|

$ 32,323,138 |

|

$ 31,633,511 |

|

|

|

Investments in unconsolidated real estate joint ventures |

|

40,170 |

|

40,535 |

|

40,636 |

|

37,780 |

|

37,695 |

|

Cash and cash equivalents |

|

562,606 |

|

561,021 |

|

722,176 |

|

618,190 |

|

532,390 |

|

Restricted cash |

|

17,031 |

|

4,832 |

|

9,519 |

|

42,581 |

|

35,321 |

|

Tenant receivables |

|

6,980 |

|

6,822 |

|

7,469 |

|

8,211 |

|

6,897 |

|

Deferred rent |

|

1,216,176 |

|

1,190,336 |

|

1,138,936 |

|

1,050,319 |

|

1,012,666 |

|

Deferred leasing costs |

|

516,872 |

|

519,629 |

|

520,616 |

|

509,398 |

|

512,216 |

|

Investments |

|

1,519,327 |

|

1,494,348 |

|

1,511,588 |

|

1,449,518 |

|

1,431,766 |

|

Other assets |

|

1,657,189 |

|

1,356,503 |

|

1,424,968 |

|

1,421,894 |

|

1,501,611 |

|

Total assets |

|

$ 38,488,128 |

|

$ 37,847,865 |

|

$ 37,699,046 |

|

$ 36,771,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities, Noncontrolling Interests, and Equity |

|

|

|

|

|

|

|

|

|

|

|

Secured notes payable |

|

$ 145,000 |

|

$ 134,942 |

|

$ 130,050 |

|

$ 119,662 |

|

$ 109,110 |

|

Unsecured senior notes payable |

|

12,092,012 |

|

12,089,561 |

|

12,087,113 |

|

11,096,028 |

|

11,093,725 |

|

Unsecured senior line of credit and commercial paper |

|

454,589 |

|

199,552 |

|

— |

|

99,952 |

|

— |

|

Accounts payable, accrued expenses, and other liabilities |

|

2,865,886 |

|

2,529,535 |

|

2,503,831 |

|

2,610,943 |

|

2,653,126 |

|

Dividends payable |

|

227,191 |

|

227,408 |

|

222,134 |

|

221,824 |

|

214,450 |

|

Total liabilities |

|

15,784,678 |

|

15,180,998 |

|

14,943,128 |

|

14,148,409 |

|

14,070,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests |

|

16,510 |

|

16,440 |

|

16,620 |

|

16,480 |

|

51,658 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

1,722 |

|

1,720 |

|

1,720 |

|

1,719 |

|

1,710 |

|

Additional paid-in capital |

|

18,238,438 |

|

18,284,611 |

|

18,434,690 |

|

18,485,352 |

|

18,651,185 |

|

Accumulated other comprehensive loss |

|

(22,529) |

|

(27,710) |

|

(23,815) |

|

(15,896) |

|

(24,984) |

|

|

|

18,217,631 |

|

18,258,621 |

|

18,412,595 |

|

18,471,175 |

|

18,627,911 |

|

Noncontrolling interests |

|

4,469,309 |

|

4,391,806 |

|

4,326,703 |

|

4,135,338 |

|

4,033,313 |

|

Total equity |

|

22,686,940 |

|

22,650,427 |

|

22,739,298 |

|

22,606,513 |

|

22,661,224 |

|

Total liabilities, noncontrolling interests, and equity |

|

$ 38,488,128 |

|

$ 37,847,865 |

|

$ 37,699,046 |

|

$ 36,771,402 |

|

|

|

Funds From Operations and Funds From Operations per Share

|

|

|

|

The following table presents a reconciliation of net income (loss) attributable to Alexandria's common stockholders, the most directly comparable financial measure presented in |

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Alexandria's common stockholders – basic |

|

$ 164,674 |

|

$ 42,917 |

|

$ 166,886 |

|

$ (91,927) |

|

$ 21,855 |

|

$ 374,477 |

|

$ 184,371 |

|

Depreciation and amortization of real estate assets |

|

291,258 |

|

288,118 |

|

284,950 |

|

281,939 |

|

266,440 |

|

864,326 |

|

798,590 |

|

Noncontrolling share of depreciation and amortization from consolidated real |

|

(32,457) |

|

(31,364) |

|

(30,904) |

|

(30,137) |

|

(28,814) |

|

(94,725) |

|

(85,212) |

|

Our share of depreciation and amortization from unconsolidated real estate JVs |

|

1,075 |

|

1,068 |

|

1,034 |

|

965 |

|

910 |

|

3,177 |

|

2,624 |

|

Gain on sales of real estate |

|

(27,114) |

|

— |

|

(392) |

|

(62,227) |

|

— |

|

(27,506) |

|

(214,810) |

|

Impairment of real estate – rental properties and land |

|

5,741 |

(1) |

2,182 |

|

— |

|

263,982 |

|

19,844 |

|

7,923 |

|

186,446 |

|

Allocation to unvested restricted stock awards |

|

(2,908) |

|

(1,305) |

|

(3,469) |

|

(2,268) |

|

(838) |

|

(7,657) |

|

(3,050) |

|

Funds from operations attributable to Alexandria's common stockholders – |

|

400,269 |

|

301,616 |

|

418,105 |

|

360,327 |

|

279,397 |

|

1,120,015 |

|

868,959 |

|

Unrealized (gains) losses on non-real estate investments |

|

(2,610) |

|

64,238 |

|

(29,158) |

|

(19,479) |

|

77,202 |

|

32,470 |

|

220,954 |

|

Impairment of non-real estate investments |

|

10,338 |

(3) |

12,788 |

|

14,698 |

|

23,094 |

|

28,503 |

|

37,824 |

|

51,456 |

|

Impairment of real estate |

|

— |

|

28,581 |

|

— |

|

7,908 |

|

805 |

|

28,581 |

|

2,778 |

|

Acceleration of stock compensation expense due to executive officer resignations |

|

— |

|

— |

|

— |

|

18,436 |

|

1,859 |

|

— |

|

1,859 |

|

Allocation to unvested restricted stock awards |

|

(125) |

|

(1,738) |

|

247 |

|

(472) |

|

(1,330) |

|

(1,640) |

|

(3,503) |

|

Funds from operations attributable to Alexandria's common stockholders – |

|

$ 407,872 |

|

$ 405,485 |

|

$ 403,892 |

|

$ 389,814 |

|

$ 386,436 |

|

$ 1,217,250 |

|

$ 1,142,503 |

|

Refer to "Definitions and reconciliations" in the Supplemental Information for additional details. |

|

|

|

|

|

(1) |

Primarily to reduce the carrying amount of one property in |

|

(2) |

Calculated in accordance with standards established by the Nareit Board of Governors. |

|

(3) |

Primarily related to two non-real estate investments in privately held entities that do not report NAV. |

|

Funds From Operations and Funds From Operations per Share (continued)

|

|

|

|

The following table presents a reconciliation of net income (loss) per share attributable to Alexandria's common stockholders, the most directly comparable financial measure presented in |

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to Alexandria's common stockholders – |

|

$ 0.96 |

|

$ 0.25 |

|

$ 0.97 |

|

$ (0.54) |

|

$ 0.13 |

|

$ 2.18 |

|

$ 1.08 |

|

Depreciation and amortization of real estate assets |

|

1.51 |

|

1.50 |

|

1.48 |

|

1.48 |

|

1.40 |

|

4.49 |

|

4.19 |

|

Gain on sales of real estate |

|

(0.16) |

|

— |

|

— |

|

(0.36) |

|

— |

|

(0.16) |

|

(1.26) |

|

Impairment of real estate – rental properties and land |

|

0.03 |

|

0.01 |

|

— |

|

1.54 |

|

0.12 |

|

0.05 |

|

1.09 |

|

Allocation to unvested restricted stock awards |

|

(0.01) |

|

(0.01) |

|

(0.02) |

|

(0.01) |

|

(0.01) |

|

(0.05) |

|

(0.01) |

|

Funds from operations per share attributable to Alexandria's common |

|

2.33 |

|

1.75 |

|

2.43 |

|

2.11 |

|

1.64 |

|

6.51 |

|

5.09 |

|

Unrealized (gains) losses on non-real estate investments |

|

(0.02) |

|

0.37 |

|

(0.17) |

|

(0.11) |

|

0.45 |

|

0.19 |

|

1.29 |

|

Impairment of non-real estate investments |

|

0.06 |

|

0.08 |

|

0.09 |

|

0.13 |

|

0.17 |

|

0.22 |

|

0.30 |

|

Impairment of real estate |

|

— |

|

0.17 |

|

— |

|

0.05 |

|

— |

|

0.17 |

|

0.02 |

|

Acceleration of stock compensation expense due to executive officer resignations |

|

— |

|

— |

|

— |

|

0.11 |

|

0.01 |

|

— |

|

0.01 |

|

Allocation to unvested restricted stock awards |

|

— |

|

(0.01) |

|

— |

|

(0.01) |

|

(0.01) |

|

(0.01) |

|

(0.02) |

|

Funds from operations per share attributable to Alexandria's common |

|

$ 2.37 |

|

$ 2.36 |

|

$ 2.35 |

|

$ 2.28 |

|

$ 2.26 |

|

$ 7.08 |

|

$ 6.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of common stock outstanding – diluted |

|

172,058 |

|

172,013 |

|

171,949 |

|

171,096 |

|

170,890 |

|

172,007 |

|

170,846 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refer to "Definitions and reconciliations" in the Supplemental Information for additional details. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-reports-3q24-and-ytd-3q24-net-income-per-share--diluted-of-0-96-and-2-18--respectively-and-3q24-and-ytd-3q24-ffo-per-share--diluted-as-adjusted-of-2-37-and-7-08--respectively-302282138.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-reports-3q24-and-ytd-3q24-net-income-per-share--diluted-of-0-96-and-2-18--respectively-and-3q24-and-ytd-3q24-ffo-per-share--diluted-as-adjusted-of-2-37-and-7-08--respectively-302282138.html

SOURCE